If you are a veteran, service member, or the surviving spouse of a veteran, you may qualify for a VA Loan—a loan backed by the Department of Veterans Affairs with many benefits. With a VA loan, borrowing requirements are more lenient and loans can be overall less costly than using a traditional conventional or FHA loan. The loan was created to set veterans up as World War II was ending, and has since helped millions of people secure homeownership. Read on to learn more about VA Loans and discover the many perks and benefits of a VA Loan when you are buying or refinancing a home.

Photo by Brandon Day on Unsplash

Who qualifies for VA Loans?

A VA Loan is available to veterans, service members, or surviving spouses. Specific requirements include service members and veterans who have:

- Served 181 days of active service during peacetime.

- Served 90 consecutive days of active service during wartime.

- Served more than 6 years of service with the National Guard or Reserves or 90 days under Title 32 with at least 30 of those days being consecutive.

You also may qualify for a VA loan as a surviving spouse of a service member who lost their life in active duty or as a result of a disability from service. The loan may also require that you are not remarried since losing your spouse. Many nuances exist, so if you think you may qualify, we are happy to discuss your possible eligibility.

If you qualify, Homelend USA can help you understand the documentation needed to secure a Certificate of Eligibility (COE) that proves you are eligible for the VA Loan.

VA Funding Fee

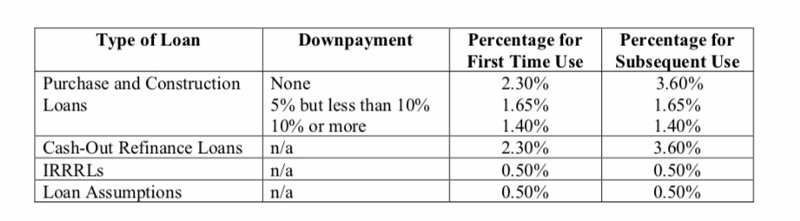

One thing to note about VA Loans is the VA Funding fee. This is a one-time payment that the eligible veteran, service member, or survivor pays on a VA loan. This fee supports the VA loan program by protecting the lender and the VA in the event of the homebuyer’s default. The VA Funding Fee is a percentage of the loan amount assessed based on the size of your downpayment. The greater the downpayment, the smaller the funding fee. The funding fee percentages are also higher if you have taken a VA Loan in the past. This chart describes VA funding fee percentages as of this posting.

The funding fee is paid at closing. It can be paid as a closing cost, financed, or it can be negotiated that the seller pays. Learn more about the funding fee.

Photo by Ian MacDonald on Unsplash

Benefits of VA Loans

There are numerous benefits to VA loans that can help veterans save thousands over the life of a loan. The lenient requirements also make homeownership possible for veterans who otherwise would be unable to buy or refinance. Benefits include:

More Lenient Requirements. When you secure a loan, you have to meet certain requirements. With a VA Loan, the benchmarks are lower and easier to meet in order to secure financing.

- No downpayment. You can secure a VA Loan with no downpayment, as opposed to the usual 3.5 percent minimum on FHA loans and 5 percent minimum on conventional loans. This huge benefit keeps initial costs low by thousands, keeps cash in your pocket upfront, and eliminates entry barriers for veterans.

- Credit. The U.S. Department of Veterans Affairs does not require a certain credit score. Lenders of VA Loans do set a limit, but it is typically much lower than it is for a conventional loan. For most, the limit is in the high 500s or low 600s.

- DTI Ratio. Lenders look at your Debt-to-Income (DTI) ratio to see how much of your income goes toward major debts. The threshold on VA Loans is typically higher than the maximum on a conventional loan.

- Foreclosure and bankruptcy. While foreclosure, short-sale, and bankruptcy can be difficult obstacles or dealbreakers with a conventional or FHA loan, VA loans may allow you to secure financing after 2 years. With Chapter 13 bankruptcy protection, this can even be shortened to one year.

Lower Costs.

- No mortgage insurance. Mortgage insurance is a monthly premium that can add thousands over the life of a conventional loan—and the only way to avoid it with traditional loans is by putting 20 percent down, a barrier most people can’t overcome. VA Loans do not require mortgage insurance, a huge savings.

- Lower rates. VA Loans offer competitive interest rates when compared to conventional mortgages.

- Lower closing costs. With VA Loans, certain closing costs cannot be charged and the lender origination fee is limited to no more than 1 percent of the loan amount. These limits keep cash in your pocket as you get started with homeownership, or they bring down the cost of refinancing.

With these many benefits, it makes sense for anyone who may be eligible for a VA Loan to look into it when considering buying or refinancing a home. Homelend USA is very familiar with the ins and outs of VA Loans, and we love to help our clients who have devoted their lives in service of the country to navigate the process of taking advantage of this product to refinance or secure a home.

Do you have questions about VA Loans? Contact us today to learn more!